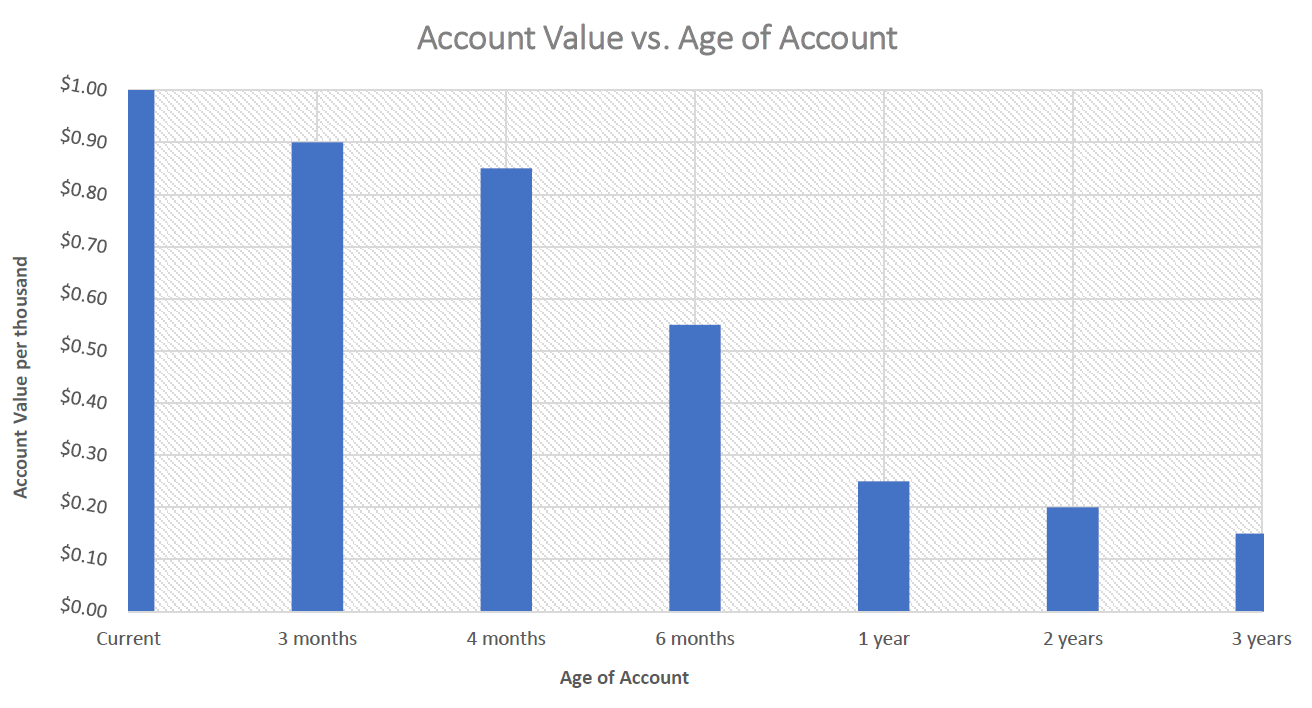

Collection Chart Graph ACCOUNTS RECEIVABLE

Accounts Receivable represents the third largest asset in American Corporations. A substantial portion of your profit potential will be negatively affected by bad debt losses. Your credit customers who are past due are holding your profits in their hands. When a company owes your company a significant sum – and is beyond your normal payment terms – you need two things:

- Prompt payment in full.

- Professional collection procedures to reflect your company’s image.

Master Credit Consultants, Inc. is a professional collection organization that is dedicated to meet these two needs of the credit executive. All MCC services are backed by a sophisticated computer system and an experienced staff of credit professionals.

For the full story, call today and cash in on all we have

to offer. Age of accounts may determine their value.

SPECIALIZED SERVICES

Nationwide coverage at no additional cost.

Our best efforts begin immediately upon receipt of your claims.

Comprehensive status reports are provided regularly to keep you advised of our progress.

Carefully selected, bonded collection attorneys throughout the U.S. and abroad.

Proceeds of all collections forwarded without delay upon clearance of funds.

MCC COLLECTION RATES

*Contingent Upon Collection*

BASIC RATES

18% on claims collected for $2500 and above

25% on claims collected between $250 and $2500

50% on claims collected below $250

35% on claims over 2 years old and/or out-of-business accounts

35% on international claims

RATES IF NECESSARY TO RETAIN COUNSEL ON YOUR BEHALF

25% contingent if collection made prior to suit being filed

30% contingent if collection made after suit is filed

In order to initiate a lawsuit, counsel may require court costs and a “nominal” non-contingent suit fee. This fee will usually not be more than 5% of the claim. MCC will always negotiate with counsel to obtain the best and least expensive arrangement for the client.

MCC will work with counsel to determine if any fees, court costs, or interest can be recovered. No legal action will be taken without the client’s authorization.

RATES ON RETURN OF MERCHANDISE

If an account is settled through the return of merchandise, one-half of the normal rates will apply.

ADDITIONAL SERVICES MAY BE PROVIDED UPON REQUEST

Uniform Commercial Code Program

- UCC-1 Financing Statement Filing

- Purchase-Money Security Interest

- Amendments, Continuations or Terminations

*These rates may be negotiable based on volume or size of accounts placed.